The area where transactions cross between the United States and Canada is a crucial point in global business. The integration of varied payment methods and the intricate dynamics of financial transactions across these neighbouring nations significantly impact businesses striving for efficient, seamless, and secure financial operations across borders.

Understanding the Payment Methods and Transactions in US and Canada

Cross-border financial transactions between the US and Canada present a labyrinth of challenges and opportunities, necessitating a comprehensive understanding of the diverse payment methods and the intricate nature of financial transactions. Such an understanding is paramount for businesses seeking to initiate and maintain international trade relationships.

Understanding the US Payment Method

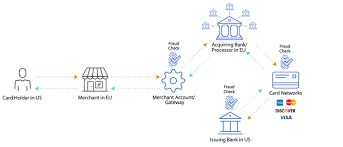

The United States financial landscape is marked by an array of payment methods facilitating both domestic and international transactions. At the core of this structure lie credit and debit cards, supported by a variety of digital payment platforms and conventional banking systems.

- Credit and Debit Cards: In the US, payment methods significantly hinge on credit and debit cards, which are extensively utilised nationwide. Visa, Mastercard, American Express, and Discover take the lead in this field, presenting a convenient and flexible approach to carrying out transactions. Their widespread acceptance streamlines cross-border dealings, mainly when conducting business with Canadian counterparts.

- Automated Clearing House (ACH) Transfers: ACH transfers serve as a reliable electronic funds transfer mechanism used widely for payroll, recurring bill payments, and B2B transactions. Businesses favour ACH for its cost-effectiveness and efficiency in handling regular financial obligations.

- Digital Payment Platforms: Emerging platforms like PayPal, Venmo, and Zelle have gained substantial traction in the US, offering swift, convenient, and secure digital transactions. Their adaptability to cross-border transactions simplifies fund transfers between the US and Canada, contributing to the ease of financial engagements.

Payment Method in Canada

Canada mirrors the US by offering a diverse range of payment methods for domestic and international transactions. Regulated by bodies like the Canadian Payments Association, Canada’s financial infrastructure boasts its unique blend of payment options.

- Interace-Transfer: Serving as a distinctive Canadian payment method, Interac e-Transfer allows secure and direct fund transfers between individuals and businesses. This method significantly streamlines cross-border financial operations, easing fund movements between the US and Canada.

- Credit Cards: Much akin to their American counterparts, credit cards, notably Visa and Mastercard, are extensively utilised in Canada. These cards are vital in facilitating smooth international transactions, guaranteeing that businesses sustain financial flexibility between the two countries.

Comprehending and manoeuvring through the complexities of payment systems in both the US and Canada are essential for businesses involved in cross-border transactions. It ensures they utilise the appropriate payment methods to accelerate trade and promote economic ties between the two nations.

Regulatory Landscape and Compliance in US-Canada Cross-Border Transactions

Understanding the regulatory landscape and compliance requirements is critical in the domain of cross-border financial transactions between the United States and Canada. The diverse financial regulations and compliance standards established by respective authorities significantly impact how businesses conduct cross-border transactions. Navigating the regulatory environments in both the US and Canada is fundamental for companies engaging in cross-border transactions. Each country has its unique set of financial regulations, compliance standards, and oversight bodies that companies must adhere to for seamless financial operations.

Regulatory Framework in the United States

Within the United States, various regulatory bodies, including the Federal Reserve, the Office of the Comptroller of the Currency (OCC), and the Consumer Financial Protection Bureau (CFPB), supervise the financial system. These bodies implement guidelines and standards to guarantee stability in finance, safeguard consumers, and promote equitable practices in international transactions.

- The Patriot Act and Anti-Money Laundering (AML) Laws: Businesses engaged in cross-border transactions between the US and Canada are required to comply with regulations established by the Patriot Act and rigorous Anti-Money Laundering (AML) laws. This adherence is crucial to prevent money laundering and unlawful financial operations.

Regulatory Framework in Canada

The Office of the Superintendent of Financial Institutions (OSFI) and the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) supervise Canada’s regulatory framework. To ensure the financial system’s integrity, these entities regulate and enforce compliance rules.

- Anti-Money Laundering and Terrorist Financing Laws: Canada maintains strict laws to combat money laundering and terrorist financing. Adhering to these laws is crucial for businesses conducting cross-border financial activities to and from the US.

Impact of Regulatory Compliance on Cross-Border Transactions

Compliance with the varied regulatory frameworks in the US and Canada significantly influences how businesses operate across borders. It’s not just about understanding payment methods; it’s about aligning transactions with legal and compliance frameworks to ensure smooth, lawful, and ethical financial engagements.

Challenges and Solutions With Regulatory Compliance on Cross-Border Transaction

Compliance with different regulatory standards in cross-border transactions presents challenges. Businesses must adapt their systems and operations to meet these standards while ensuring seamless financial transactions. Leveraging technology and compliance expertise can help address these challenges effectively.

- Harmonisation of Regulations: Streamlining and aligning regulations between the US and Canada could simplify compliance for businesses engaged in cross-border transactions. Harmonising standards could potentially reduce complexity and facilitate more straightforward transactions.

Conclusion

The intricate web of cross-border payments between the US and Canada necessitates a comprehensive understanding of the divergent payment methods and transactional intricacies prevalent in each country. For businesses participating in international trade, acknowledging these differences and similarities is pivotal in facilitating streamlined, secure, and efficient cross-border transactions. By embracing the appropriate mix of payment methods tailored to the specific needs of the US and Canadian markets, businesses can overcome challenges, maximise opportunities, and foster a robust financial relationship between the two nations. Understanding the nuances of payment methods in each country forms the bedrock for successful and sustainable cross-border transactions, propelling businesses towards successful international financial engagements.

Cross-border transactions between the US and Canada require a deep understanding of the payment methods available in both countries to ensure a smooth and efficient exchange of funds. By grasping the nuances of each payment system, businesses can navigate the complexities of international trade and foster successful financial interactions between these neighbouring nations.