Introduction

The two most important identification documents for any Indian are PAN – the permanent account number and the Aadhaar card. PAN card is issued to businesses and individuals for tax purposes, and Aadhaar is issued to all residents of India. The Income tax department issues your PAN card, whereas your Aadhaar is issued by UIDAI – the Unique Identification Authority of India.

Although only PAN cards are related to taxation, the Indian government has made it compulsory to link both documents for e filing of income tax return . This article will tell you everything about PAN and Aadhaar card linking.

Latest News on PAN and Aadhaar Linking

Per the latest update from the Income tax department, every PAN card holder (except the ones who come under the exempt category) must link their PAN number to their Aadhaar by 30th June 2023. Initially, the date was 31st March 2022, but it was extended to 20th June 2022.

Effective 1st July 2023, the PAN card will be inoperative if not linked with Aadhaar. The Indian government has taken this step to curb and regulate tax evasion.

Who is Exempted from PAN-Aadhaar Linking?

Only a few people are exempt from linking these two important documents; the rest of everyone must get their PAN linked with their Aadhaar for ITR tax filing.

- People who are residents of Jammu and Kashmir, Meghalaya, and Assam

- As per Indian Income Tax Act, 1961, a Non-Resident taxable person

- Super Senior Citizens (people above 80 years)

- People who are not Indian citizens

Why is It Important to Link PAN and Aadhaar?

Below are some of the reasons everyone should get their PAN and Aadhaar linked today:

- The Income tax department will reject all the ITRs that are filed where PAN and Aadhaar card is not linked.

- Accessing many government services, such as opening bank accounts, receiving subsidies, and applying for passports, may become difficult if these documents are not interlinked.

- In the case of re-issuing a PAN card due to the old one, lost or damaged individuals can face difficulty in getting a new one if these documents are not interlinked.

Are There Any Consequences Attached for Not Linking?

Here are some of the results of not linking a PAN card with an Aadhaar card:

- Taxpayers will not be able to do manual or e-filing of income tax returns.

- The IT department will not approve the pending returns and pending refunds.

- Taxpayers may have to pay higher TCS and TDS.

- The government will not issue the TCS or TDS certificate, which will not appear in Form 26AS.

- Individuals will not have the option of submitting 15G/15H for NIL TDS.

- Individuals will not have access to the following things since PAN will be inoperative:

- They won’t be able to open a bank account.

- They won’t be issued a new debit or credit card.

- Not be able to purchase mutual funds exceeding INR 50,000.

- No cash deposits exceeding INR 50,000 at the bank or post office.

- Won’t be allowed to purchase pay orders or bank drafts exceeding INR 50,000.

- Any prepaid payment through pay order, bank draft, or banker’s cheque for more than INR 50,000 in a financial year.

- Won’t be allowed to sell or purchase services or goods for more than INR. 2,00,000 per transaction.

If someone cannot link their PAN and Aadhaar by the given due date, they can get it done within 30 days by paying a late fee of INR 1000 to the prescribed authority. If you need clarity, discuss with an online tax consultant and get clarity.

How to Link PAN and Aadhaar?

To link your PAN and Aadhaar, follow the simple steps below:

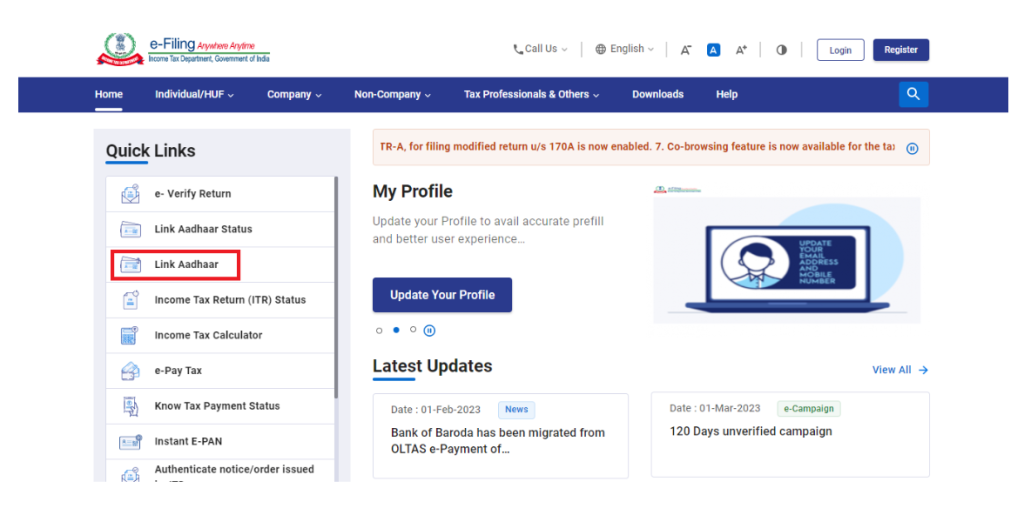

- Login to the income tax e-filing portal.

- Click on the ‘Link Aadhar’ option under the ‘Quick Links’ on the homepage.

- You will have to enter your PAN and Aadhaar details and click validate.

- Select the Continue button to submit the request.

- Enter the details and click on the Link Aadhaar and enter the OTP.

- Your request will be submitted for linking PAN and Aadhaar.

Final Thoughts

It is compulsory, as per the income tax department, for everyone to interlink their PAN and Aadhaar. Every taxpayer (besides the one in the exempt category) should get it linked to avoid delay in filing their ITRs. You can always refer to the above steps to easily interlink your documents.