In the fast-paced and dynamic foreign exchange (Forex) market, selecting the most suitable tools and platforms is paramount to executing trades precisely and efficiently. MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are esteemed choices embraced by traders worldwide, both developed by the renowned MetaQuotes Software Corporation, headquartered in Cyprus. In this comprehensive Trading Platforms Comparison, we meticulously examine these two platforms, endeavoring to aid you in determining which one best aligns with your distinct Forex trading requirements. Our rigorous analysis will shed light on each platform’s unique attributes and capabilities, empowering you to make an informed decision that can profoundly impact your trading success.

MetaTrader 4: The Gold Standard of the Industry

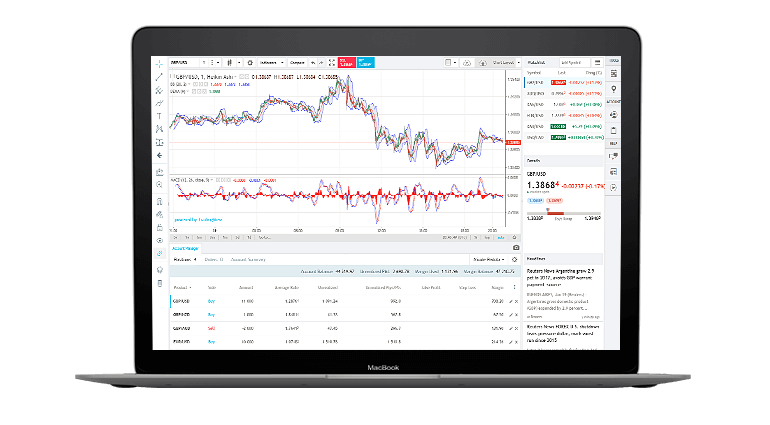

There is no denying that MT4 has earned its reputation as the undisputed industry standard, boasting unparalleled recognition and widespread usage among Forex brokers and traders across the globe. Renowned for its user-friendly interface, extensive features, and unwavering stability, MT4 has rightfully secured its position as the go-to trading platform for countless professionals and newcomers alike. The fact that nearly every Forex broker offers access through MT4 speaks volumes about its popularity and widespread adoption within the industry.

MetaTrader 5: A Platform Designed for Diversity

While MT5 shares some design similarities with its predecessor, it was purposefully crafted to cater to a different market segment with specific trading requirements. Distinguishing itself from MT4, MT5 has been engineered to facilitate trading across a broader range of assets, including stocks and commodities. Additionally, it thoughtfully addresses the compliance needs of U.S. regulations, such as adhering to the “no hedging rule.” These distinctive features make MT5 an attractive and versatile choice for traders seeking diverse opportunities and tailored functionalities.

Critical Differences Between MT4 and MT5

- Market Diversity: In this Trading Platforms Comparison, MT5 takes the lead by expanding beyond the Forex market, granting traders access to various stocks and commodities exchanges. If your trading interests extend beyond Forex, MT5 undoubtedly emerges as your preferred platform.

- Hedging Capability: One noteworthy difference is that MT4 supports hedging, allowing traders to simultaneously hold both long and short positions on the same currency pair. However, due to specific regulatory requirements, MT5 needs to have hedging functionality, making it better suited for traders who do not require such capabilities in their strategies.

- Programming Language: MT5 gains an edge using the advanced MQL5 programming language. This powerful language supports “black box” programming, enabling more leisurely development of trading robots and expert advisors. Although MQL4 in MT4 has been upgraded to include similar features, MQL5 remains the more sophisticated and sought-after language for algorithmic trading.

- Backtesting Speed and Functionality: In this Trading Platforms Comparison, MT5 stands out by offering faster execution and the ability to conduct simultaneous multi-currency pair backtesting. For traders relying heavily on extensive backtesting as a crucial part of their trading strategy, MT5’s enhanced capabilities can save valuable time and enhance efficiency.

Conclusion: Choosing the Right Trading Platform

The ultimate decision regarding the ideal trading platform for your need’s hinges on your individual preferences and requirements. If you primarily focus on Forex trading and value a user-friendly interface, stability, and extensive third-party support, MT4 remains the platform of choice for numerous top traders. However, suppose you aspire to trade a more comprehensive range of assets, such as stocks and commodities, and seek advanced programming capabilities for algorithmic trading. In that case, MT5 emerges as the more fitting option. It is essential to acknowledge that while MT5 offers several advantages over MT4, such as faster backtesting and a more advanced programming language, the need for backward compatibility between the two platforms could be a notable drawback for traders who have already developed and tested strategies on MT4.

In conclusion, while MT4 and MT5 have their respective strengths and weaknesses, MT4 generally maintains its standing as the preferred platform among most traders. This is evident in the continued promotion and availability of MT4 on MetaQuotes’ website, despite the release of MT5. However, it is crucial to diligently evaluate your specific trading needs and preferences before arriving at a decision, as the right platform for you will be contingent upon factors such as the assets you trade and the complexity of your trading strategies. Remember that the world of Forex trading is dynamic, and staying informed about platform updates and industry developments will empower you to make the most informed choice for your trading success.