The main objective of purchasing term insurance plans is to safeguard your loved one’s finances in the event of your passing. Term insurance policies allow you to establish this safety and maintain their financial security even when you may not be around.

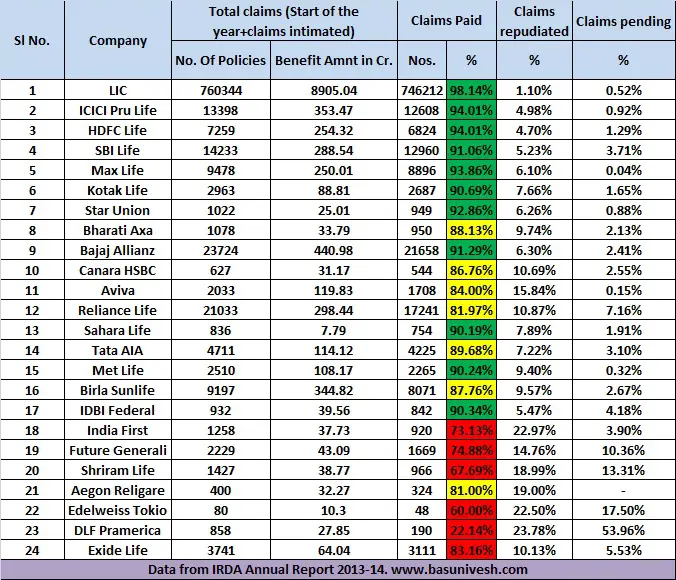

To ensure that they have a financial backup when you may no longer be there, you should pick the ideal coverage from the finest insurance company. How do you figure this out? The quickest way to find out is to look at the claim settlement ratio. Here are a few details upon the same to help you find a better term insurance plan.

What is the claim settlement ratio (CSR)?

The claim settlement ratio gets calculated by considering the number of actual claims paid against the number of claims the company received in a year. For instance, the company’s claim settlement ratio can be 95% if the insurer pays out 95 of the 100 life insurance claim requests it receives in a given accounting year.

The claim settlement ratio is the total amount of claims settled each year divided by the total number of claims filed in that same year, then multiplied by 100.

Aside from the CSR, one should also look at the premium rates the company offers. Using an online term insurance premium calculator can come in handy to find the estimates of your premium and affordable plans.

Factors that influence the claim settlement ratio-

Even though the claim settlement ratio may be a crucial indicator, you should look at other factors besides the company’s claim settlement ratio. This is because, sometimes, claims can be denied for good reasons, which lowers the company’s overall claims ratio. Among the causes are:

1. Initial claims –

Because the claim is made too early in the tenure, many term insurance claims can be denied. As per current rules, an insurance plan and its claim can be challenged if the insurer isn’t informed about important information or is given false information, within two years of the policy’s start date.

2. Unfound claims –

This is a typical issue in the insurance sector. Numerous false and illegitimate assertions are made. People purchase family members’ insurance policies by concealing or changing important dates in the application procedure.

3. Misrepresentation or withholding of material information –

The policyholder is responsible for disclosing all material facts that could affect the underwriter’s judgments under the first insurance principle.

So, when purchasing the plan, you must be completely truthful. You can have no recourse at that point if your claim is rejected due to “non-disclosure or misrepresentation of material facts” if you lie or omit information.

4. Claim settlement ratio limitations –

This ratio is essential when choosing a term insurance plan. It would help if you considered additional factors besides the CSR because it has some significant drawbacks, such as the fact that the total claim value is not considered in the calculation of the claim settlement ratio.

5. The claim settlement ratio is not entirely indicative of the claim experience –

The CSR data does not indicate, for instance, if the company settles claims with a TAT of three days or three months. The Claim Settlement Ratio does not specify the claim procedure or claim simplicity as well

Selecting the proper term policy –

There are numerous term insurance providers that provide a variety of term plans. The claim settlement ratio can be unquestionably a significant criterion when comparing the various term insurance plans. However, you should also pay attention to the following:

- Coverage –

When selecting term insurance, this may be the most crucial consideration. Make sure you purchase a comprehensive plan with all the coverage your family requires. Consider additional elements as well, such as tax savings. The package can be flexible and customised to your needs by adding riders. Ensure to check the term insurance premium calculator online to find beneficial plans that can be easy on your pocket and may help your family in need.

- Claims procedure –

Your dependents should be able to easily and quickly file claims with the insurer you select following your passing. These variables may make it easier to choose the finest protection from the top-term insurance providers.

When you purchase term insurance plans, you must be truthful and open. Being clear about your aims can help you achieve the right plan while purchasing term insurance from a reputable insurer with a high claim settlement ratio.

Insurance is the subject matter of solicitation. For more details on benefits, exclusions, limitations, terms, and conditions, please read the sales brochure/policy wording carefully before concluding a sale.