In general, the Forex market is open almost 24/7, which is one of the reasons for its tremendous success. In practice, every investor can trade whenever that is convenient for him: when drinking his morning coffee before going to the office or, maybe, late at night when all his family is asleep and no one will disturb him. Yet, there are periods when trading is more effective and productive. So, below, you will learn when are the best times to trade foreign currencies in South Africa.

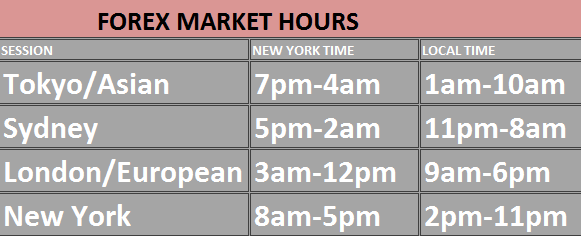

First, you must know that about 65% of deals on the global Forex market are executed within 4 main sessions:

· Sydney (Pacific region) ― from 10 PM GTM to 7 AM GTM;

· Tokyo (Asian) ― from 11 PM GTM to 9 AM GTM;

· London (European) ― from 8 AM GTM to 7 PM GTM;

· New York (American) ― from 1 PM GTM to 10 PM GTM.

Obviously, during the Sydney session, the overwhelming majority of deals involve currency pairs with Australian and New Zealand dollars, during the Tokyo session ― Japanese Yen-based currency pairs, and so on.

Also, when there are overlaps between some of these sessions, the trading volume and liquidity multiply.

The next point is to determine what the time zone of South Africa is. So, in winter, it is GTM+2 (EST+7), and, in summer, it is GTM+1 (EST+6).

Now, let us provide the results of the research on the most productive times for Forex trading, which was conducted by Traders Union. They invited over 2 thousand traders to take part in the survey. And it showed that the most profitable time for them is from 6 AM GTM to 12 PM GTM.

As for the most advantageous trading sessions in South Africa, these are from 8 AM to 2 PM and from 8 PM to 2 AM.

And, speaking about the days of the week, according to the study mentioned, the most favorable one is Wednesday. The second place belongs to Thursday.

Besides, we must highlight that there are periods when it is recommended to refrain from executing deals. In the first place, that refers to the time when liquidity drops. For example, such a moment comes when it is around 7 AM in South Africa. At this point, there is only one open session ― the Tokyo one ― and it is closing. As a result, there is a risk of delays in execution and slippage, which can result in losses. In addition, if you do not want to pay overnight commissions, you had better close all your positions till the end of the current session.

To sum up, now you know what the most productive and the riskiest periods for trading foreign currency pairs in South Africa are. So, when planning your trading routine, be sure to take the recommendations above into consideration.