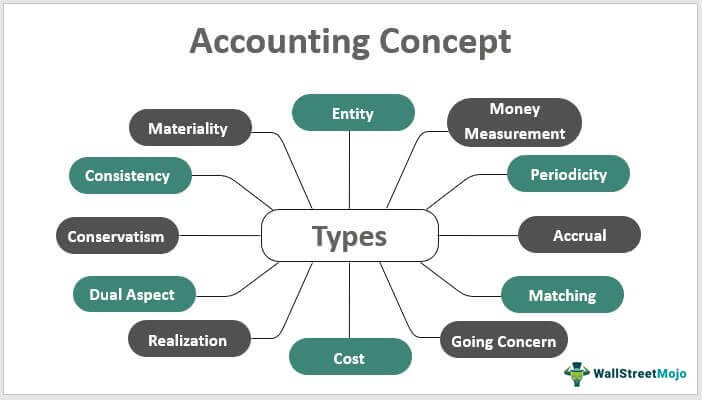

Understanding basic accounting concepts is essential for small businesses as these help entrepreneurs to make better predictions regarding their future. Moreover, with the knowledge of accounting concepts, entrepreneurs can make more innovative, and better financial decisions can be made. In this article, we will discuss some of the accounting small business owners must know.

1. Accruals

There are two main accounting methods that are important. One of them is cash basis, and the other one is accrual basis. Most small businesses generally begin with cash base accounting; however, the accrual base accounting gives a much more thorough as well as a better understanding of the financial position. Hence small business owners must know about this concept. Moreover, Generally Accepted Accounting Principles require companies to use accrual accounting.

2. Consistency

Another important accounting concept is consistency. The concept of consistency says that once you choose a proper accounting method, you should try to stick to it as per financial records. Thus, this allows a company to compare their performance in different periods of accounting accurately. So, it is suggested to stick to one method of accounting.

3. Going Concerned

The going concept states that you should make the assumption that your business is in a proper financial condition and will remain so in the foreseeable future. This concept allows companies to defer certain expenses for the future period. However, if your auditor finds evidence that your business can’t continue and is unable to pay off its obligations, in that, the company would be required to start considering the liquidation value of assets.

4. Conservation

This is another important accounting concept that business owners must be aware of. In this concept, revenue, as well as expenses, are treated separately. This concept states that businesses should try to recognize expenses sooner and recognize revenue only when there is certain clarity for it. It is important to note that it is prudent in terms of business to overestimate expenses rather than income.

5. Economic Entity

One of the most crucial aspects of small businesses is keeping company and personal finances separate. Only business transactions should be reflected in financial statements. Personal spending, for example, should not be charged to corporate expenses.

If you’re a corporation or limited liability company, failing to follow this idea might make virtual bookkeeping considerably more difficult and potentially get you into legal trouble. On the other hand, you can have minimal liability protection by keeping your business and personal finances separate.

6. Materiality Concept

This is quite a simple concept and means that businesses should properly record each and every financial transaction that might affect business decisions. Though the transaction may be minor, it is always important to get a comprehensive look at the business. Business accounting software generally makes it easier to record each transaction. So it is important you get a basic hold of this concept.

Summing Up

This was all about accounting concepts, and hopefully, you have understood which are some of the most crucial accounting concepts every small business owner should be aware of. If these seem to be daunting to you, you can contact accounting firms like Bookkeepers Vancouver, who can help you out in these activities.