A crucial first step in your investing journey is creating a free online demat account. Understanding the important considerations before creating a demat account might help you avoid future issues as more individuals resort to digital platforms for their financial requirements. This article explores the important factors to take into account for a free demat account opening online for investment purposes.

- Research the Account Maintenance Charges

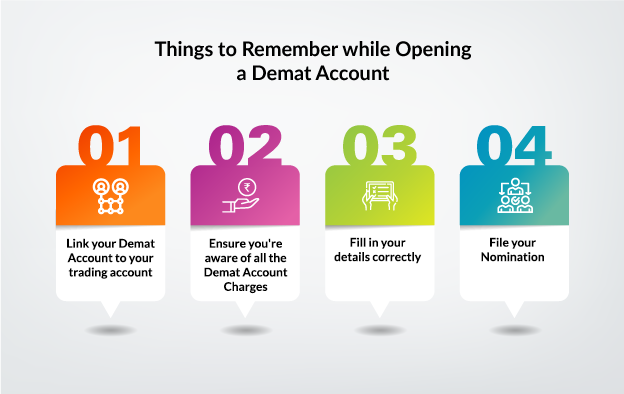

Even if a lot of platforms promote free demat accounts, it’s important to comprehend the true pricing structure. The majority of demat accounts have transaction fees, yearly maintenance fees, and other unstated expenses that might arise in the future. Spend some time carefully reviewing the fee schedule, taking note of the costs associated with fund transfers, pledge services, and account statements. Examine many service providers to identify one that provides affordable maintenance fees in line with your investment objectives and transaction volume.

- Verify the Documentation Requirements

Make sure you have all required digital papers on hand before beginning the account opening procedure. Your PAN card, identification, proof of address, and recent photos are usually the essential prerequisites. For verification, you’ll also need a current cellphone number and bank account. The online application procedure will go more smoothly and account activation delays can be avoided if these papers are accurately scanned and easily accessible.

- Check the Platform’s Trading Integration

Seek out a demat account provider that has smooth trading platform connection. Because it enables you to manage your portfolio effectively and make transactions fast, this connection is crucial. Examine if the platform offers real-time market information, a user-friendly interface, and mobile trading features. You can make well-informed investing selections and carry them out quickly without juggling many apps if your trading integration is strong.

- Evaluate Customer Support Services

When it comes to operating a site that offers any sort of financial service, it is paramount that one gets very good customer support. This assessment must determine whether the available customer support services can offer support during the night and if they offer multiple choices such as live chat and phone help, and approximate response rate. Read comments and feedback rendered by other clients regarding their experience in dealing especially with the technical team regarding issues and concerns on transaction-related queries.

- Consider the Additional Features and Benefits

Examine the extra features that the demat account provider provides in addition to the fundamental services. These might include financial advising services, research papers, or investor education materials. Tools for technical analysis, portfolio tracking, and market insights are provided by some suppliers. These characteristics could greatly improve your investing experience and help you make more informed decisions but shouldn’t be solely decisive.

Conclusion

Selecting the best demat account provider to open trading account is a crucial choice that may have a big influence on your investing journey. You may make an informed decision by carefully weighing these five important factors: maintenance costs, documentation needs, trade integration, customer support, and extra features. It’s important to read the tiny print and comprehend all terms and conditions before beginning the account opening procedure because the word “free” frequently has a catch.