An MT4 liquidity bridge is a software program that enables investors to connect with liquidity providers through the MetaTrader 4 (MT4) platform. By using a third-party bridge, traders can access a wider range of brokers and liquidity providers than without the usage of this technology. This article will explore how MT4 bridges work and what benefits they offer to retail traders.

Most people who are interested in forex trading have probably heard of the term “liquidity bridge,” but they may not be entirely sure what it means. In a nutshell, a liquidity bridge is a tool that helps connect an investor’s account to a Forex liquidity provider. This can be used to send orders and check prices, and most bridges also come with a connection to the broker’s prices so that you don’t need a separate data feed.

Some other benefits of using an MT4 liquidity bridge include having access to more brokers and being able to communicate with them directly. This can be a big advantage for retail investors who want to get the best possible price for their trades.

With most 3rd party service providers, installation and set-up is quick and easy, so you can save time and money. Plus, an MT4 liquidity bridge can provide you with more flexibility and better order execution than other methods.

A MetaTrader liquidity bridge is a highly configurable order sending/receiving system that can be easily configured to send and receive orders from a brokerage. In addition, most of these 3rd party software programs provide a plug-and-play real-time data feed system that allows the user to receive continuous prices without spending more resources on costly data feeds.

An MT4 liquidity bridge directly links an investor’s account and an MT4 server. This allows the user to receive instant updates on their account status without relying on periodic updates from other data feeds. This is especially useful for investors who need to keep track of their positions in real-time.

Selecting an MT4 Bridge:

If you’re looking for an MT4 liquidity bridge, there are several factors you’ll need to consider. Speed is one of the most important factors – you’ll want to make sure that your platform is able to connect quickly and efficiently with a potential MT4 liquidity provider.

When choosing an MT4 liquidity bridge, it is important to consider the reliability of the 3rd party service provider. An unreliable company can cause frustration and may not even solve the problem you were having in the first place. Therefore, it is essential to pick a reliable company with good communication to avoid any issues.

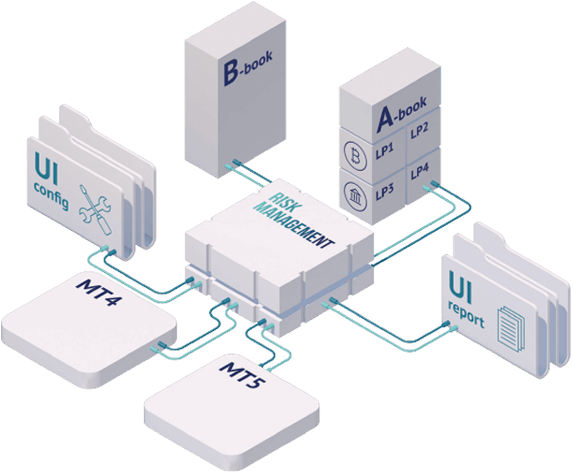

Risk management tools are essential. Reading reviews about a liquidity bridge on forums, particularly Forex Forums, is a good approach to discover whether or not it provides risk management tools. This allows you to receive a variety of perspectives on the product before making your final decision.

If you’re looking for an easy-to-use MT4 liquidity bridge, it’s important to do your research before making a purchase. There are a variety of different options on the market, so it’s crucial to find one that best suits your needs. By taking the time to learn about the different features of each product, you’ll be able to make an informed decision and choose the right liquidity bridge for your trading operation.

By taking the time to learn about the different features of each product, you’ll be able to make an informed decision and choose the right liquidity bridge for your trading operation.