Emerging at the forefront of the global banking sector, financial technology (FinTech) combines innovation and technology to drive efficiency. The fintech revolution has ushered in a new era of banking services, offering seamless financial transactions. However, as in any evolving industry, the march toward progress isn’t without risks. A robust strategic risk management in banking operations is paramount to navigating this terrain of opportunities and challenges.

Global FinTech Landscape and the Risks Involved

In the midst of all this technological revolution, several global hubs have distinguished themselves. Cities like San Francisco, London, and Singapore are prime examples, fostering a fertile ground for fintech startups and established banks. As these hubs develop, they intertwine financial services and technology, engendering a complex set of risks.

As integral as fintech is to the modern banking sector, it’s susceptible to unique risks. Regulatory changes, technological vulnerabilities, data privacy issues, and operational inefficiencies can all jeopardize an institution’s stability. Understanding these hazards is the first step towards implementing effective financial technology strategic risk management.

Unpacking Strategic Risk Management in Fintech

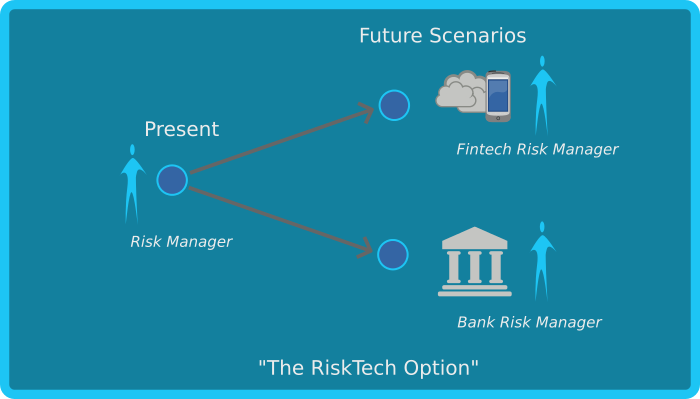

Risk management is no longer just about complying with regulations; it’s about designing strategies that holistically consider all potential pitfalls. Strategic risk management is this proactive and comprehensive approach, anticipating and managing risks to ensure the continuity and growth of the organization.

Strategic risk management in banking operations, therefore, encompasses a broad range of elements. This includes regulatory compliance, data privacy, cybersecurity, and operational efficiency, amongst others. By managing these aspects, banks can mitigate risks and capitalize on fintech’s potential.

Identifying the Right Risk Management Strategies

The first strategy is adherence to regulatory compliance. With fintech operations spanning across different jurisdictions, compliance with various laws and regulations is pivotal. It ensures the legality of operations and fosters trust amongst clients and stakeholders.

Data privacy is another crucial strategy. As banks become more digital, vast amounts of sensitive customer data are processed daily. Ensuring this data is handled securely, and in line with privacy laws, is essential to maintain customer trust and avoid legal complications.

Thirdly, cybersecurity is a vital strategy. As digital transactions increase, so does the risk of cyber-attacks. Implementing robust cybersecurity measures protects banks and their customers from potential financial losses and reputational damage.

Lastly, banks must strive for operational efficiency. Efficient processes minimize errors, reduce costs, and improve customer satisfaction, thereby decreasing operational risks.

Creating a Robust Risk Management Framework

Having the right strategies is the starting point, but implementing them requires a structured framework. A strategic risk management platform is a tool that guides this process. It helps banks identify, assess, mitigate, and monitor risks effectively.

- Risk Identification – This involves recognizing the various threats a bank could face. These might be cyber threats, regulatory changes, or internal operational risks. Identifying these risks allows banks to develop strategies to counter them.

- Risk Assessment – This determines the severity and probability of identified risks. This evaluation is necessary for prioritizing mitigation efforts. Without understanding the potential impact of risks, a bank can’t strategically allocate resources to combat them.

- Risk Mitigation – Involves putting in place measures to reduce the likelihood or impact of identified risks. For example, adopting advanced cybersecurity measures can reduce the risk of data breaches.

- Risk Monitoring – This involves continually tracking identified risks and the effectiveness of mitigation strategies. Monitoring allows banks to adapt their risk management strategies in line with evolving circumstances.

Building a Strong Risk Culture

A successful risk management framework isn’t just about strategies and platforms; it’s also about culture. A robust risk culture is one that promotes transparency, encourages accountability, and prioritizes ongoing education. Transparency in risk management involves open communication about risks and the measures in place to mitigate them. It assures stakeholders and fosters trust.

Accountability, on the other hand, ensures everyone in the organization understands their role in managing risks. From top management to junior staff, everyone should know their responsibilities concerning risk management. Lastly, ongoing education keeps staff updated on the latest risks and mitigation strategies. An informed workforce is better equipped to identify and manage risks proactively.

Working with Risk Management Consulting Firms

In some cases, collaborating with risk management consulting firms can enhance a bank’s risk management capabilities. These firms bring specialized knowledge and experience that can help banks understand their risk profile better and design more effective mitigation strategies.

However, banks should exercise due diligence when choosing a consulting partner. It’s essential to work with firms that understand the specific challenges of fintech and can provide tailor-made solutions.

The Importance of Refining Risk Management Strategies

Given the rapidly evolving fintech environment, banks must continually refine their risk management strategies. Emerging technologies, regulatory changes, and new types of cyber threats require banks to be adaptable and responsive.

It’s not enough to have a one-time risk management strategy. Instead, banks should aim for a dynamic risk management in finance that evolves in tandem with the fintech environment. This approach ensures banks remain resilient and competitive, even amidst uncertainty.

Strategic risk management in fintech banking operations is a necessary safeguard in the face of a rapidly evolving fintech landscape. By understanding the risks, implementing appropriate strategies, fostering a strong risk culture, and continuously refining risk management strategies, banks can harness the power of financial technology while safeguarding their operations and their customers. This robust approach to risk management is an investment that will pay dividends in the form of trust, resilience, and long-term success.