In today’s dynamic business environment, understanding a company’s financial health is more critical than ever. Whether you’re an investor, a competitor, or a strategic planner, accessing accurate financial data is a cornerstone of informed decision-making. Financial statements, which include the income statement, balance sheet, and cash flow statement, provide essential insights into a company’s performance over time. But how do you go about finding the last five years’ financial statements of companies? Here’s a comprehensive guide that leverages tools, techniques, and expert advice to help you navigate this process.

Why Accessing Financial Statements Matters

Financial statements are indispensable for various purposes:

- Investor Decisions: To evaluate profitability and growth trends.

- Competitor Analysis: To benchmark performance against industry peers.

- Corporate Compliance Checks: To ensure a company adheres to legal and financial obligations.

- Deal-Making: To validate mergers, acquisitions, or funding activity reports.

“Transparency in financial reporting is vital for fostering trust among stakeholders and driving sound business decisions,” says MD Sadique Akhter, President and CEO of Financh. “Our tools empower users with deep insights into company profiles and analysis.”

How Financh Solves the Business Problem

Financh addresses the challenges of finding reliable and comprehensive company financial reports, particularly for private companies and startups. By partnering with public and private data providers across 185 countries, Financh ensures accurate and up-to-date information. The platform specializes in providing last 5-year financial statements, which include income statements, balance sheets, cash flow statements, and key financial ratios for over 400 million companies.

Financh’s advanced tools make it easy to:

- Access detailed company financial statements

- Analyze company profiles and performance metrics.

- Gain insights into M&A activity, venture capital trends, and funding activity reports.

“Financh’s platform streamlines the process of obtaining and analyzing historical financial data, empowering businesses and investors to make data-driven decisions,” adds MD Sadique Akhter.

Steps to Access the Last Five Years’ Financial Statements:

1. Start with Public Databases and Filings

Public companies are legally required to disclose their financial statements, typically through their investor relations websites or regulatory bodies like the SEC (Securities and Exchange Commission) in the U.S. Search for the following reports:

- Annual Reports (10-K): These include detailed company financial reports and industry insights.

- Quarterly Reports (10-Q): Ideal for tracking recent trends.

- Proxy Statements (DEF 14A): For governance and compensation details.

2. Leverage Market Intelligence Tools

Market intelligence tools are indispensable for gathering comprehensive data:

- Platforms like Financh offer private company data, company performance tracking, and competitive benchmarking features.

- Use tools to download financial data directly, including balance sheets, income statements, and ratio charts.

3. Explore Private Company Data

Unlike public companies, private firms are not obligated to disclose their financials, making data collection more challenging. However, platforms like Financh specialize in providing startup directories and insights into venture capital trends and funding and investment data.

Financh’s proprietary technology gathers and organizes data from multiple sources, including supply chain insights, investor profiles, and deal sourcing platforms, ensuring a seamless experience for users.

4. Analyze Financial Statements Using Competitive Benchmarking

Once you obtain financial data, the next step is analysis:

- Compare metrics like revenue growth, profitability, and debt levels using competitive benchmarking.

- Track business credit scores and company performance trends to evaluate financial stability.

Key Sources for Financial Statements:

1. Regulatory Filings

Regulatory bodies such as the SEC, Companies House (UK), and MCA (India) maintain databases with years of filings available for public scrutiny. Search by company name or registration number to access records.

2. Data Aggregators and Deal Sourcing Platforms

For those seeking a consolidated view, platforms like Financh aggregate data from various sources. They provide insights into:

- M&A activity

- Investor profiles

- Supply chain insights

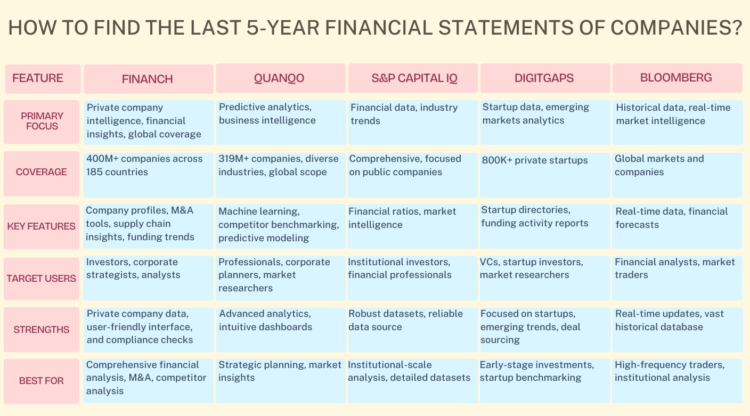

3. Bloomberg, Quanqo and Capital IQ

Platforms like Bloomberg, Quanqo and S&P Capital IQ are invaluable for accessing historical financial data. These tools provide robust datasets, including financial ratios, industry trends, and market intelligence. However, these services often come with a steep learning curve and subscription fees, making Financh a cost-effective alternative for those seeking similar insights.

4. Company Websites and Annual Reports

Most public companies provide direct access to annual reports on their websites under the “Investor Relations” section. These reports often include a five-year summary of financial performance.

5. Professional Networks and Subscriptions

Platforms like Financh and specialized subscriptions to databases such as Bloomberg or Capital IQ offer advanced analytics, including deal sourcing platforms and market intelligence tools.

Navigating Challenges in Private Data Collection

For private companies, financial transparency varies significantly. Here’s how to overcome challenges:

- Proprietary Databases: Use services like Financh, which offer exclusive access to funding and investment data.

- SWOT Analysis: Evaluate strengths, weaknesses, opportunities, and threats to understand market positioning.

Red Flags to Watch For

When reviewing financial statements, be cautious of:

- Inconsistent Data: Ensure data aligns across various reports.

- Hidden Liabilities: Dig deeper into footnotes for contingent liabilities.

- Unrealistic Projections: Cross-check growth claims with industry standards.

The Role of Technology in Financial Reporting

Advances in technology have streamlined access to financial data:

- AI-Powered Analytics: Automates the extraction of critical insights from large datasets.

- Predictive Modeling: Leverages historical data to forecast trends.

- Blockchain: Enhances transparency in corporate compliance checks.

Conclusion

Finding the last five years’ financial statements of companies involves a blend of strategy, tools, and due diligence. Whether you’re analyzing private company data, tracking funding activity reports, or benchmarking against competitors, having access to reliable data is crucial. Tools like Financh provide a cost-effective and comprehensive alternative to traditional platforms like Bloomberg and Capital IQ, simplifying the process for businesses and investors.

“In today’s fast-paced market, the ability to access and analyze financial statements can be a game-changer for businesses and investors alike,” says MD Sadique Akhter. By combining cutting-edge technology with global data partnerships, Financh offers unparalleled insights into company performance, enabling users to make informed decisions with confidence. As the financial landscape grows increasingly complex, having a trusted partner like Financh is not just beneficial—it’s essential.