When a borrower is searching for a business loan, the first thing they check for is the qualifying requirements. If the borrower qualifies for a business loan, the loan is authorised. We will examine the qualifying requirements for small business loans and business loan papers in this blog.

Leaving the limitations of a job and starting your own business is one of the most fulfilling experiences a person can have. A businessman will go to tremendous lengths, from traveling miles to working for lengthy periods to guaranteeing that the firm develops correctly. Additionally, a business owner spends all of his savings to ensure the business doesn’t ever run out of money.

However, there are times when more money is necessary, such as when a business owner recognises an expansion opportunity or when a supplier fails to make a payment on time. It is when a business loan appears to be the best alternative for him, and he eagerly awaits its approval.

And when he considers applying for a business loan, the first thought that comes to mind is business loan eligibility, followed by the papers necessary for a business loan. The business loan eligibility criteria consist of the conditions established by the loan lender to finalise the business loan, which the borrower must meet.

Business Loan Eligibility Check in India

The eligibility requirements for the online business loan vary according to the lender. Let us now discuss some of the most often used MSME loan Eligibility criteria used by the majority of lenders:

- MSMEs should operate for a minimum of two years consecutively.

- Few lenders are willing to lend to fledgling firms due to their questionable capacity to repay the debt.

- Lenders will want to examine your most recent income tax return and balance sheet to confirm that you can repay the company loan.

- The firm should have generated a minimum of INR 10 lakhs in revenue in the preceding year.

- It is a critical criterion for company financing eligibility.

- As previously said, this indicates that you will be able to repay the company loan on time.

- Your home should not be used as a business location.

- In other words, your home and work location should be distinct. It is also a critical factor in determining your eligibility for a company loan.

- You should be the owner of either the commercial space or the residence.

- Your previous year’s income tax return filing (ITR) should exceed INR 2.5 lakhs.

There are several ways to determine business loan eligibility in 30 seconds, one of which is using a business loan EMI calculator. You may easily and quickly check your company financing eligibility online.

The business loan emi calculator assists you in budgeting and expenditure planning by providing an accurate view of your monthly requirements. This valuable tool enables you to make informed decisions about your online business loan amount and term. You may use a business loan eligibility calculator to determine your eligibility for a business loan.

Input an estimate of your yearly revenue and monthly company commitments, such as payments on existing or ongoing loans, credit card payments, and more, to obtain accurate results. Personal costs such as rent and home supplies are not included in this calculation.

After calculating the EMI, add it to your existing monthly commitments and subtract it from your projected monthly income to get a sense of your monthly costs, which will help you with business loan requirements.

Business Loan Eligibility Criteria

Apart from the qualifying requirements and business loan documentation, a few other conditions must be met. Additional criteria include the following:

- The CIBIL Score: It is a numerical indicator of your creditworthiness. Most lenders would often give a business loan in India to applicants with a high CIBIL Score since they want to ensure they will receive their money back. If your credit score falls below the required CIBIL Score for business loans, you must first improve your credit score before applying for a business loan.

- Certificate of Registration: The document attesting to the corporation’s or company’s creation. This certificate is often referred to as the license under which a businessman operates.

- Business Plan: Outlining the rationale for your firm and the financial backing you have is occasionally requested by lenders. If you genuinely want to obtain a business loan, you must present an exhaustive report detailing the project’s study.

How Can You Increase Your Business’s Loan Eligibility?

The following are some strategies for increasing your business’s loan eligibility:

- Loan repayment histories cannot be altered in the past.

- However, it is recommended that you avoid defaulting on future purchases.

- Ascertain that all payments are made on schedule and that your bank account has a sufficient amount.

- It is critical to ascertain the reasons behind credit score declines.

- The same thing might happen as a result of late credit card payments or unpaid EMIs.

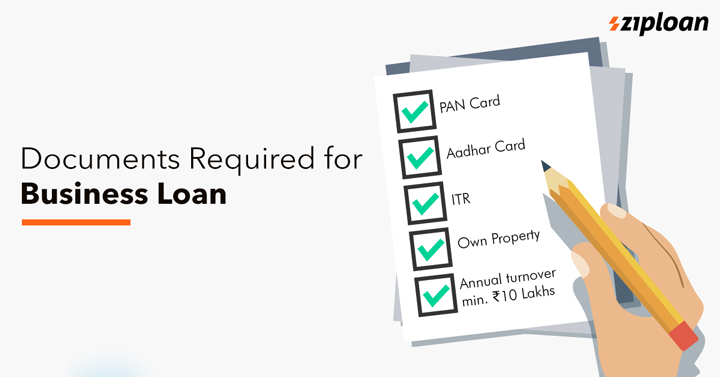

Documents Required For Business Loan

Personal KYC: PAN card.

Residential Address Proof (Anyone): Rent agreement, driver’s license, Voter’s ID, Ration card, Aadhaar Card, Passport.

Banking: Last six months’ current account bank statement.

Business KYC (Anyone): GST registration certificate, shops, and establishment certificate.

Financial documents (For loans greater than 20 Lakhs): 2 years Audited financials, Last 2yrs ITR, GST Returns of 6 months.