Investing is a powerful tool for growing wealth, and there are various strategies investors can employ to achieve their financial goals. Two popular methods are compound interest and margin investing, each with unique benefits and risks. Understanding the impact of these approaches is essential for making informed investment decisions.

Compound Interest:

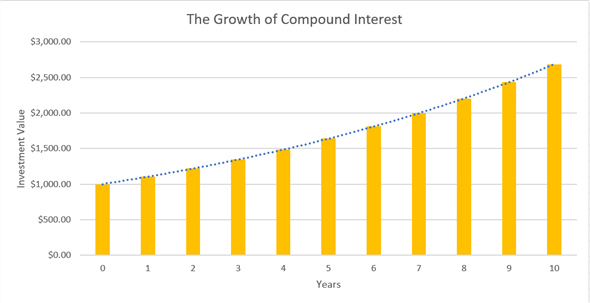

Understanding compound interest is crucial in finance as it greatly impacts wealth accumulation over time. In simple terms, it refers to earning interest not only on the initial investment but also on the accumulated interest over time. This compounding effect can substantially boost the value of an investment over the long haul.

The power of compound interest lies in time. The longer the investment remains untouched, the more pronounced the compounding effect becomes. The key takeaway is that the earlier one starts investing, the more time the investment has to compound and grow.

Compound interest is typically associated with conservative investment options, such as bonds, certificates of deposit (CDs), or some index funds. These assets may offer relatively lower returns compared to riskier investments, but they are considered more stable and reliable over time.

Margin Investing:

On the other hand, margin investing involves borrowing funds from a brokerage firm to purchase additional securities, effectively leveraging one’s investment. Margin accounts allow investors to purchase more shares than they could with their available cash, which may increase their potential gains.

Margin can be a double-edged sword. Investing on margin can result in substantial gains during a favourable market trend. However, losses can be equally magnified if the market moves against the investor. Moreover, margin accounts come with interest charges, which can erode returns if not managed carefully.

Margin investing is generally considered a high-risk strategy and is more suitable for experienced investors who understand the potential consequences of using leverage. It is a common strategy used in speculative trading and day trading, where investors try to profit from brief changes in prices. You can also use a margin calculator to know the profits and margins.

Comparing the Impact on Investments:

To compare the impact of compound interest and margin on investments, let’s examine their performance under different market conditions.

1. Bull Market (Upward Trend):

When stock prices are on the rise in stock market India then margin investing during a bull market can result in a significant increase in gains. Leveraging investments can amplify returns, outperforming the growth achieved through compound interest alone. However, investors must exercise caution, as the risk of substantial losses is equally heightened.

2. Bear Market (Downward Trend):

Margin investing can be disastrous during a bear market when stock prices are declining. The losses incurred on leveraged investments can be devastating, potentially wiping out the entire investment capital and leaving the investor in debt.

3. Stable Market (Minimal Fluctuations):

In a stable market, compound interest can be a reliable and safe strategy. While the returns may not be as spectacular as those generated through margin investing in a bull market, the investment’s value continues to grow steadily over time.

Conclusion:

Both compound interest and margin investing have their place in the world of finance, but they cater to different investment philosophies and risk tolerances.

Compound interest is a patient and disciplined approach best suited for long-term investors who prioritize stability and steady growth. On the other hand, margin investing appeals to those seeking higher returns in a shorter time frame but are willing to accept the increased risk associated with leverage. Make sure to use a margin calculator to calculate the profits and margins.

Ultimately, the choice between compound interest and margin depends on an investor’s financial goals, risk appetite, and time horizon. While compound interest can be a reliable strategy for most investors, margin investing requires a higher level of skill and caution, making it more suitable for seasoned investors who can effectively manage the risks involved. Regardless of the chosen strategy, seeking professional financial advice is crucial to make well-informed decisions and optimize investment outcomes.