CFD trading is becoming more and more popular in the United Kingdom. Most local traders prefer diversifying their portfolio with those contracts adding stocks, indices, some commodities and even cryptocurrencies. CFDs are easy to trade and understand, which makes them very popular among various categories of traders.

Understanding CFDs

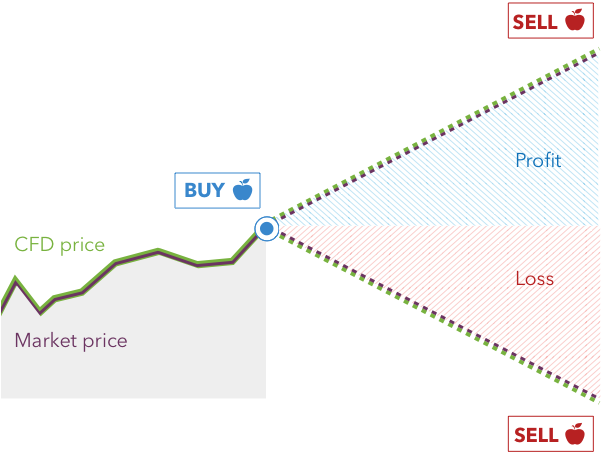

Contract for difference (aka CFD) is a special contract that most Forex brokers offer to their clients. Those contracts allow you to earn profits on price changes of various assets. The difference between buying a CFD for a stock, for instance, and the stock itself is pretty clear.

When you buy a stock, you purchase a share in the company. Moreover, you can rely on dividends, if they apply. Buying a stock is a pretty long process (which takes up to three days). When it comes to CFD, you buy a contract immediately. However, you don’t purchase the stock itself. You can earn money on the price difference, but the dividends will not be paid to you.

CFD Trading in the United Kingdom

To provide services in the United Kingdom, Forex brokerage firms should receive the Financial Conduct Authority watchdog license. Thus, CFD trading UK can be considered safe as the FCA is one of the strictest financial regulators in the field.

First and foremost, traders from the United Kingdom should pay attention to the license that a particular Forex Broker owns. The local financial regulator allows brokers to sell CFD contracts to clients, but traders are recommended to start trading with regulated companies only.

What Do I Need to Start Trading CFDs?

Once you have found a regulated and trustworthy brokerage firm, you need to create an account there and fund your trading balance with an amount that is above the minimum deposit requirements. The average minimum deposit amount is £100 in this industry. Some brokers allow you to start with an even higher amount (£250+) but you can also find some companies that allow starting even with £50.

If you are new to trading and CFD trading, in particular, you can also start with a demo account. To practice your trading skills, you don’t need real money to be deposited. You only need to create an account and by doing this, you will be provided with access to a trading platform. Once your platform familiarization is over, you can start trading CFDs using real money balance.