In the world of finance and investment, volatility is a term that often sends shivers down the spines of even the most seasoned traders. It’s the measure of how much the price of an asset fluctuates over time, and it plays a crucial role in determining the risk and potential return of an investment. In this article, we will embark on a journey to explore the concept of volatility, its significance in various asset classes, and how it affects traders and investors. Additionally, we’ll take a closer look at the innovative online trading platform like Immediate Sprint, and how it handles volatility in the realm of cryptocurrency trading.

Understanding Volatility: The Basics

Volatility is the financial world’s way of expressing the degree of uncertainty or risk associated with an asset’s price movement. It can be caused by various factors, including economic events, market sentiment, geopolitical tensions, and more. To understand volatility better, let’s break it down into two key components:

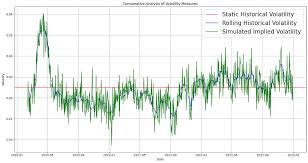

- Historical Volatility: This measures how much an asset’s price has fluctuated in the past. It is typically calculated using statistical methods and historical price data.

- Implied Volatility: This represents the market’s expectation of how much an asset’s price is likely to fluctuate in the future. It is derived from options pricing models and reflects investors’ collective outlook.

Comparing Volatility Across Asset Classes

Volatility can vary significantly between different asset classes, and understanding these differences is crucial for investors looking to diversify their portfolios. Here’s a comparative analysis of volatility in various asset classes:

- Stocks and Equities: Stocks of publicly traded companies are known for their moderate volatility. While individual stocks can experience sharp price swings due to earnings reports or news events, diversified portfolios tend to exhibit more stability.

- Bonds: Bonds are generally considered less volatile than stocks. They provide a fixed interest rate and a predictable stream of income, making them a popular choice for risk-averse investors.

- Commodities: Commodities such as oil, gold, and agricultural products can experience significant price fluctuations due to supply and demand dynamics, weather conditions, and geopolitical factors.

- Cryptocurrencies: Cryptocurrencies, like Bitcoin and Ethereum, are notorious for their high volatility. Prices can surge or plummet rapidly, often driven by speculative trading, news, and regulatory developments.

Navigating the Volatile Crypto Markets

An online trading platform, has garnered attention for its approach to handling the inherent volatility of the cryptocurrency market. Here’s how it addresses the challenges posed by volatile digital assets:

- Advanced Algorithms: Online platforms employ cutting-edge algorithms that analyze market data in real-time. These algorithms can identify trading opportunities and execute orders swiftly to take advantage of price fluctuations.

- Risk Management Tools: To protect investors from excessive losses, platforms offer risk management tools like stop-loss orders and take-profit orders. These tools automatically execute trades when specified price levels are reached.

- Educational Resources: Recognizing the importance of informed trading decisions, online platforms provide educational resources and market analysis to help traders understand the crypto market better.

Volatility and Your Investment Strategy

The level of volatility in your chosen asset class should align with your investment goals and risk tolerance. Here are some considerations for investors:

- Risk Tolerance: If you have a low tolerance for risk, you may prefer investments with lower volatility, such as bonds or diversified mutual funds.

- Diversification: Diversifying your portfolio across various asset classes can help mitigate the impact of volatility in any one area.

- Long-Term vs. Short-Term: Consider your investment horizon. If you’re planning for retirement, you may be able to weather short-term market volatility. However, if you need funds for a specific goal in the near future, lower-volatility assets may be more suitable.

- Market Research: Stay informed about the factors that influence the volatility of your chosen assets. Economic indicators, news events, and market sentiment can all play a role.

- Utilize Tools: If you’re trading cryptocurrencies or other volatile assets, make use of risk management tools and trading platforms to help navigate market fluctuations.

Conclusion

Volatility is an integral part of the financial markets, impacting various asset classes in different ways. While some investors embrace volatility as an opportunity for profit, others seek more stable investments to protect their capital. Regardless of your risk tolerance and investment preferences, understanding volatility is key to making informed decisions. With its innovative approach to managing cryptocurrency volatility, it offers a platform for traders looking to participate in the dynamic world of digital assets. As with any investment, it’s essential to conduct thorough research, assess your risk tolerance, and choose your assets wisely. Whether you’re a seasoned trader or a newcomer to the financial markets, volatility will always be a factor to consider in your investment journey.