Are you an Indian investor looking to diversify your investment portfolio and explore the US stock market? Global investment opportunities are more accessible than ever before. Investing in US stocks from India is an excellent way to diversify your portfolio, potentially earn higher returns, and take advantage of the global economy’s growth.

But if you’re a novice investor, the process can seem confusing and daunting. In this blog, we will help you understand the steps you need to take to invest in US stocks from India.

From the basics of indirect and direct investment options to answering frequently asked questions, we’ve got you covered. Follow this guide to make informed decisions and start investing in the biggest companies in the US!

Why should you consider investing in US stocks?

Investing in the US stock market comes with several benefits:

- Diversification: Overseas investing lets you diversify your portfolio, as the US stock market is home to many large, established companies from different sectors, offering a wide range of investment opportunities.

- Mitigate risk: Investing in US stocks can also help you hedge against the volatility of the Indian stock market. It can help reduce the risk of major dips in your portfolio due to unforeseen events such as political or economic instability, and ensure that it remains strong and resilient.

- Tap into a strong market: Historically, the US stock market has delivered strong returns, making it an attractive option for long-term investments. By investing in US stocks, you can gain exposure to leading companies in innovation and technology, providing opportunities for potential growth and solidifying your portfolio.

How to invest in US stocks

There are two main ways for Indian investors to invest in US stocks: through indirect and direct investments. Let’s understand how each of these methods works.

Indirect investments

This method involves buying the shares of an Indian mutual fund or an ETF that invests in US stocks, thus providing you with some exposure to US companies.

Mutual funds are the most popular way to invest indirectly in the US. Many Indian mutual fund houses offer funds that invest in US equities. Such mutual funds invest in a diversified portfolio of US stocks, providing you with exposure to a wide range of companies, from well-established blue-chip companies to emerging startups.

For example, an investor in India can invest in a mutual fund that invests in US companies like Apple, Amazon, or Google. The mutual fund will buy stocks of these companies and distribute the returns to its investors.

Exchange-traded funds (ETFs) are another popular way to invest indirectly in US stocks. ETFs are investment funds that trade on stock exchanges like individual stocks. They offer a low-cost, convenient, and transparent way to invest in a basket of US stocks that track specific indices like the S&P 500 or the Nasdaq Composite.

Indirect investments are convenient options for investors who want to invest in US stocks but don’t have the time, knowledge, or resources to invest directly.

Direct investments

In contrast, the direct investment method requires you to buy and sell individual stocks of US companies listed on stock exchanges like NYSE or NASDAQ

To invest directly in US stocks, an Indian investor needs to open an overseas trading account with a domestic or US-based broker; the broker will take care of ensuring compliance with Indian and US regulations.

The basic requirements are simple — you will need a PAN card, a domestic bank account, a trading account, and a demat account. You also need to follow US tax regulations: this means you’ll have to file tax returns and pay tax on the income earned from US stocks.

Direct investment provides you with greater control, flexibility, and the potential for higher returns. However, it can require some more research, analysis, and risk management. It’s important that you have a good understanding of the US stock market, companies, and economic trends before investing directly.

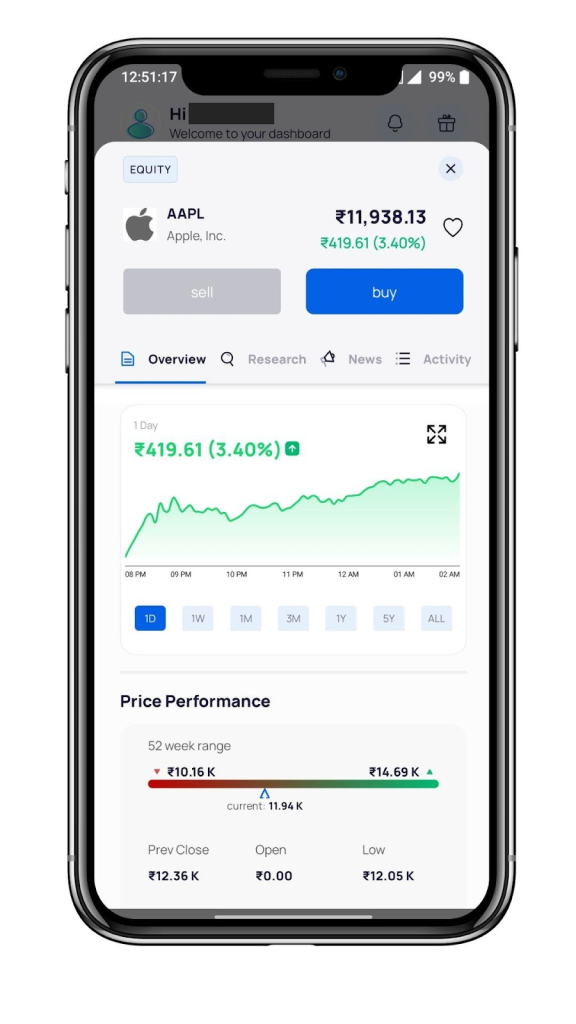

Stock market apps simplify the process by handling all the documentation and regulatory requirements. In addition, the best stock market apps also offer features such as AI-based stock recommendations that can greatly cut down on your research time.

Charges associated with US stock investing

It’s important to factor in the following charges when investing in US stocks to avoid any surprises:

- Tax collected at source (TCS): As per Indian regulations, TCS of 20% is collected on foreign remittances under the Liberalised Remittance Scheme (LRS). This amount can be refunded at the time of filing income tax returns.

- Capital gains and dividend tax: Indian investors must pay capital gains tax on the sale of US stocks. The tax rate is based on the holding period of the stock and the investor’s tax bracket.

- Bank charges: Banks may charge fees for transferring money to overseas accounts or currency conversions. However, note that certain investment apps allow you to trade with zero commissions and zero subscription fees.

- Broker fees: Brokers charge fees for buying and selling stocks.

- Currency conversion charges: Many credit card companies and banks charge additional fees for currency conversions.

FAQs

- How are Indians taxed for their investments in the US stock market?

Indian investors investing in US stocks directly or indirectly may be subject to taxes in both India and the US. However, due to India’s Double Taxation Avoidance Agreement (DTAA) with the US, you won’t actually have to pay the same tax twice. Consult your CA for more clarity about this.

- How do I fund my account?

To fund your trading account with a US-based broker, you can use wire transfer, online transfer, or credit/debit card. The exact method and fees will vary depending on the broker.

- What documents are required for investing in US stocks from India?

To invest in US stocks from India, you need a PAN card, a bank account, a trading account, and a demat account.

- How much can I invest in US stocks?

The Reserve Bank of India (RBI) has set certain guidelines for individuals looking to invest in foreign securities, according to which each person can send up to $250,000 (around INR 2 crore as of this writing) per annum. However, some investment platforms may have their own minimum investment requirements, so it’s essential to choose a platform that suits your investment goals and budget.

- What are the various charges incurred when investing in US stocks?

You should be aware of the following charges when investing in the US stock market:

- Tax collected at source (TCS)

- Capital gains and dividend tax

- Bank charges

- Broker fees

- Currency conversion charges

Let your portfolio soar like an eagle

Investing in US stocks from India has become much more accessible in recent years, thanks to the availability of investment apps and partnerships among banks and brokers. With a wide range of large and established companies across different sectors, the US stock market offers diverse investment opportunities that can help you diversify your portfolio and hedge against the volatility of the Indian stock market.

With the right investment strategy and tools, investing in US stocks can offer you a lucrative avenue for long-term growth and a means to achieve your financial goals.

Yogesh Kansal – Bio

Yogesh is a Co-Founder at Appreciate, a fintech platform helping Indians achieve their financial goals through globally diversified one-click investing.